INVESTING

30 Money Lessons from the World’s Wealthiest Minds

Published

3 months agoon

Shutterstock

Throughout history, some of the world’s wealthiest and most influential individuals have shared timeless insights about money, value, and success. These quotes transcend mere financial guidance, delving instead into the philosophies that guide our relationships with wealth. They offer lessons in patience, integrity, gratitude, and the responsibilities that accompany fortune. By examining these perspectives, we can discover that true richness often arises from purpose, contribution, and self-awareness. As you explore these words of wisdom, consider how they may inspire you to shape not just your financial destiny, but also the legacy you wish to leave behind.

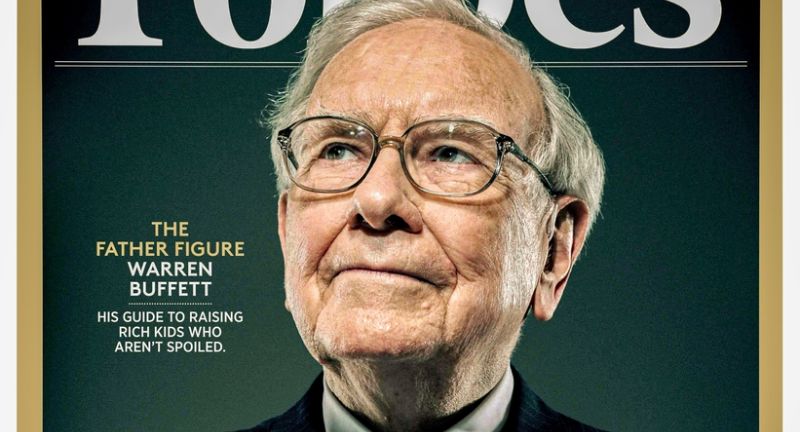

“Price is what you pay. Value is what you get.” – Warren Buffett

Shutterstock

This quote highlights the importance of looking beyond the immediate cost of something and focusing on the long-term benefits it may provide. It reminds us that just because something has a high price tag does not guarantee it offers true worth. In life and investments, understanding intrinsic value rather than being swayed by superficial figures leads to better decisions. Ultimately, it encourages a mindset that prioritizes quality and substance over surface-level appearances.

“Someone’s sitting in the shade today because someone planted a tree a long time ago.” – Warren Buffett

Shutterstock

This statement underlines the power of foresight and long-term planning. It reminds us that the comforts and opportunities we enjoy often stem from the actions of those who came before us. Financially, this can mean that investments and savings made early on can benefit future generations. It encourages thinking beyond immediate gratification and considering what kind of legacy we are leaving behind.

“The most important quality for an investor is temperament, not intellect.” – Warren Buffett

Shutterstock

This statement asserts that success in investing depends more on emotional stability than on raw intelligence. It highlights how control over one’s reactions to market fluctuations is vital to long-term financial growth. Instead of being swayed by fear or greed, a steady temperament ensures well-informed and rational decision-making. In essence, it’s emotional discipline, not brilliance, that often makes the real difference.

“I would rather earn 1% off a hundred people’s efforts than 100% of my own efforts.” – John D. Rockefeller

Shutterstock

This quote underscores the power of leverage and collaboration. Instead of relying solely on personal labor, Rockefeller highlights the strength found in leveraging the work of many to achieve far greater results. In economic terms, it speaks to the scalability of a business model that involves multiple contributors. It’s a lesson in building systems and networks that multiply wealth through shared efforts.

“If your only goal is to become rich, you will never achieve it.” – John D. Rockefeller

Shutterstock

This statement suggests that wealth pursued as an end in itself is a hollow target. True success often emerges from passion, innovation, and the pursuit of meaningful objectives rather than the blind chase of money. By focusing on creating value, serving others, or enhancing our own abilities, wealth often becomes a natural byproduct. It reminds us that genuine fulfillment and long-term prosperity come from deeper motivations.

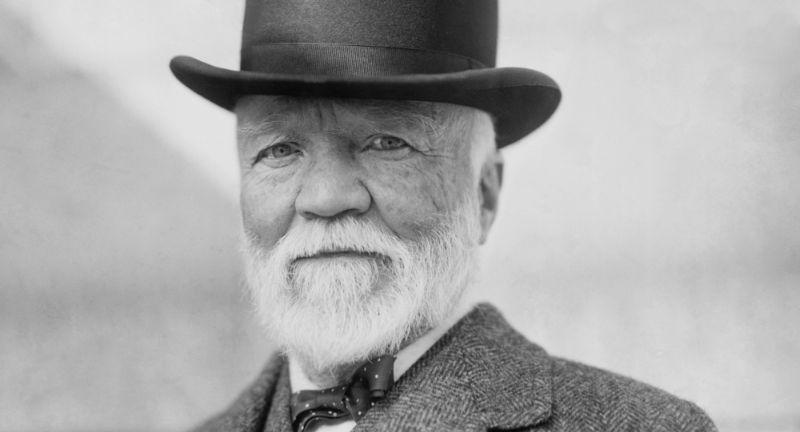

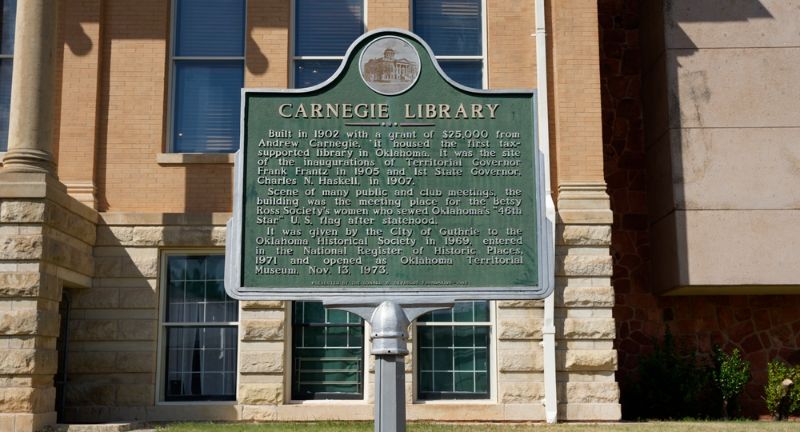

“The man who dies rich dies disgraced.” – Andrew Carnegie

Shutterstock

Carnegie’s quote highlights the moral responsibility that comes with great wealth. He believed that holding onto large fortunes until death, without giving back, was a misuse of one’s resources. The statement encourages the wealthy to invest in philanthropy, education, and community upliftment during their lifetimes. It reflects the idea that true legacy is measured by generosity and positive impact rather than retained riches.

“Surplus wealth is a sacred trust which its possessor is bound to administer in his lifetime for the good of the community.” – Andrew Carnegie

Shutterstock

This quote frames the idea that excess wealth is not just personal property, but a resource meant for the greater good. Carnegie believed that with great fortune comes a moral obligation to improve society. It implies that one should not hoard wealth but instead invest it thoughtfully for public benefit. This perspective encourages a legacy built on uplifting others and creating enduring positive change.

“A business that makes nothing but money is a poor business.” – Henry Ford

Shutterstock

Ford’s quote suggests that the true value of a company lies in more than just profits. A business should also improve lives, foster innovation, and contribute positively to its community and customers. Merely generating money without creating meaningful products, services, or social benefit can be spiritually and morally impoverishing. It encourages entrepreneurs to look beyond the bottom line toward broader measures of success.

“Money is like an arm or leg—use it or lose it.” – Henry Ford

Shutterstock

Comparing money to a limb implies it must remain active and exercised to maintain its usefulness. Hoarding wealth, like failing to move a limb, can lead to stagnation and atrophy of potential. By investing, spending wisely, or supporting worthwhile ventures, one ensures that money circulates and grows. Ultimately, it reminds us that idle resources often diminish in value and opportunity.

“If you can count your money, you don’t have a billion dollars.” – J. Paul Getty

Shutterstock

Getty’s remark humorously points out that vast wealth transcends normal measures of counting. When fortunes become so large, exact tallies lose significance. It implies that true financial magnitude often stands beyond everyday comprehension. In a broader sense, it acknowledges that immense wealth exists on a different scale, changing the very nature of how money is perceived.

“If you don’t find a way to make money while you sleep, you will work until you die.” – Warren Buffett

Shutterstock

This quote emphasizes the importance of creating passive income streams to achieve financial independence. It suggests that relying solely on active work for income can become a lifelong burden. By investing wisely or building businesses and assets that generate income without constant labor, one can free themselves from endless toil. Ultimately, it encourages strategic thinking to ensure a sustainable and more peaceful future.

“Money is like manure. You have to spread it around or it smells.” – J. Paul Getty

Shutterstock

By comparing money to manure, Getty suggests that wealth must be put to productive use rather than hoarded. Just as spreading manure fertilizes the ground and fosters growth, distributing money can stimulate economies and create opportunities. Hoarding wealth can lead to social stagnation and resentment, much like manure concentrated in one spot creates a foul odor. The metaphor encourages active philanthropy, investment, and circulation of capital for the betterment of society.

“I can understand wanting to have millions of dollars… Once you get beyond that, I have to tell you, it’s the same hamburger.” – Bill Gates

Shutterstock

Gates’ observation highlights that beyond basic comfort and security, additional wealth doesn’t fundamentally change life’s simple pleasures. No matter how rich one becomes, human experiences—like enjoying a meal—remain essentially the same. The statement encourages reflection on what truly matters after one’s needs are met. It questions the pursuit of endless wealth and reminds us that satisfaction isn’t solely tied to money.

“Money has no utility to me beyond a certain point.” – Bill Gates

Shutterstock

This quote conveys the idea that once basic needs and comforts are secured, extra money doesn’t significantly enhance one’s quality of life. It reflects how personal satisfaction plateaus once material necessities are fulfilled. Beyond that threshold, wealth can be more meaningful when directed towards uplifting others or advancing society. It suggests a moral framework where money’s best use is often altruistic rather than personal accumulation.

“If you look at what you have in life, you’ll always have more. If you look at what you don’t have, you’ll never have enough.” – Oprah Winfrey

Shutterstock

Winfrey’s insight stresses the power of gratitude and perspective. By focusing on what we already possess—whether material or emotional—we cultivate a sense of abundance. Conversely, a mindset centered on lack perpetuates dissatisfaction, no matter how wealthy one becomes. It teaches us that true richness often stems from appreciation rather than sheer accumulation.

“Your true wealth is not measured by what you have, but by what you are.” – Oprah Winfrey

Shutterstock

This quote emphasizes the importance of character, values, and personal growth over material possessions. It suggests that wealth measured in terms of money alone is incomplete. True prosperity, according to this viewpoint, arises from qualities like compassion, integrity, and authenticity. It shifts the focus from external accumulation to internal enrichment.

“Do not save what is left after spending; instead spend what is left after saving.” – Warren Buffett

Shutterstock

This principle encourages prioritizing savings and investment over discretionary spending. It inverts the common approach of saving whatever remains, instead instructing one to secure their future first. By doing so, individuals ensure a more stable financial foundation and reduce the risk of reckless expenditure. The idea promotes long-term financial health and disciplined money management.

“Being the richest man in the cemetery doesn’t matter to me.” – Steve Jobs

Shutterstock

Jobs implies that amassing wealth is meaningless if you neglect life’s deeper purpose and experiences. Material success loses its significance once life is over. He suggests that what truly counts is the impact you have, the relationships you cultivate, and the legacy you leave. It’s a reminder to cherish personal fulfillment over mere financial accumulation.

“Money is a scoreboard where you can rank how you’re doing against other people.” – Mark Cuban

Shutterstock

Cuban’s observation highlights how some perceive wealth as a measure of success and status. It reflects a competitive mentality, where net worth becomes a way to keep score in life’s race. While it acknowledges that money can reflect certain achievements, it also points out a potentially superficial focus. Ultimately, it invites us to question whether comparing fortunes truly yields fulfillment or meaning.

“I never went into business to make money. I went into business so I could do interesting things.” – Richard Branson

Shutterstock

Branson’s approach emphasizes passion, curiosity, and innovation as the driving forces behind entrepreneurship. Instead of viewing business purely as a wealth generator, he frames it as a platform for creativity and adventure. By focusing on stimulating projects and new ideas, financial success often follows naturally. This perspective invites aspiring entrepreneurs to pursue meaningful work that energizes them rather than just chasing profits.

“Money was never a big motivation for me, except as a way to keep score. The real excitement is playing the game.” – Donald Trump

Shutterstock

Here, money is depicted more as a metric than an ultimate goal. Trump suggests that the true thrill lies in the challenge, strategy, and competition inherent in business. Financial gain becomes secondary to the creativity, negotiation, and leadership skills developed along the way. It’s a reminder that the journey and personal growth can be more rewarding than the prize itself.

“After a certain point, money is meaningless. It ceases to be the goal. The game is what counts.” – Aristotle Onassis

Shutterstock

Onassis echoes the sentiment that past a certain threshold, additional wealth adds little personal enrichment. The pursuit transforms into a game—an intellectual and strategic exercise rather than a quest for mere material gain. This perspective suggests that challenge, skill, and ambition drive individuals once basic comforts are secured. It reframes the meaning of wealth, focusing on personal fulfillment rather than monetary milestones.

“There is only one boss. The customer. And he can fire everybody in the company from the chairman on down simply by spending his money somewhere else.” – Sam Walton

Shutterstock

Walton’s statement underscores the power customers hold in a free market. By choosing where to spend their money, consumers effectively dictate which businesses thrive or fail. It reminds companies that no amount of internal hierarchy can override the ultimate authority of the marketplace. The quote emphasizes customer satisfaction, value creation, and service as the keys to sustainable success.

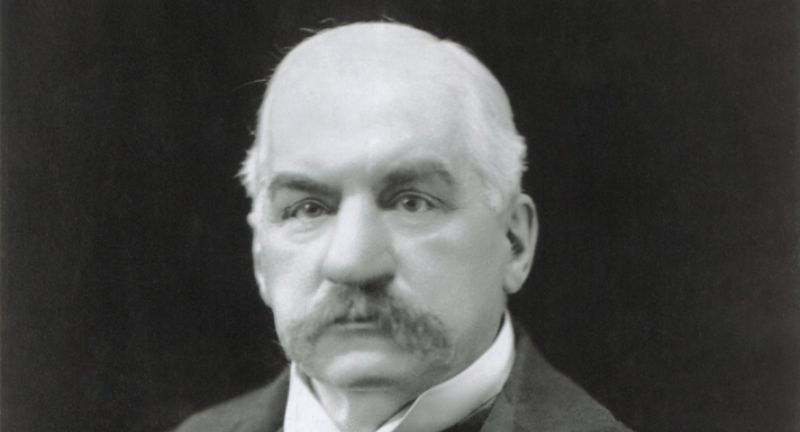

“Millionaires don’t use astrology, billionaires do.” – J.P. Morgan (attributed)

Shutterstock

This quote, often attributed to J.P. Morgan, plays on the idea that extremely wealthy individuals might seek guidance from unconventional sources. Whether literal or metaphorical, it suggests that higher levels of wealth may come with a broader willingness to explore all avenues of insight. It reflects a sense of mystery or open-mindedness in pursuing success. Ultimately, it challenges conventional norms about what it takes to reach extraordinary financial heights.

“The big money is not in the buying and selling, but in the waiting.” – Charlie Munger

Shutterstock

Munger’s insight emphasizes patience as a crucial element of investment success. Rather than constant trading, he suggests that long-term holdings and enduring the market’s fluctuations lead to substantial gains. This perspective values resilience, thoughtful analysis, and trust in one’s convictions over quick profits. It’s a reminder that time can be one of the most powerful tools in building true wealth.

“You must know how to spend money to make money, but at the same time, you must save for the future.” – Li Ka-shing

Shutterstock

This quote stresses the balance between strategic spending and prudent saving. Investing intelligently in opportunities can generate growth, but it’s equally important to maintain a safety net. It underscores financial literacy, moderation, and forward-thinking planning. The message is that true wealth management involves both calculated risks and cautious stewardship of resources.

“The wealth that we have today must serve to create new opportunities for tomorrow.” – Carlos Slim Helú

Shutterstock

Slim’s statement advocates for using current resources to build a better future. It’s a forward-looking approach where present capital should be invested in innovation, education, and development. By doing so, wealth can expand in ways that benefit not just the individual but society at large. It positions money as a tool for progress rather than a static treasure to be guarded.

“Money is just a consequence. If you do your job well, the profitability will come.” – Bernard Arnault

Shutterstock

Arnault’s perspective shifts the focus from profit to the quality of one’s work. Excellence, innovation, and dedication to craft naturally lead to financial rewards. By prioritizing the creation of outstanding products or services, economic success follows as a byproduct. It reinforces the idea that integrity and passion often pave the way to wealth.

“No man can become rich without himself enriching others.” – Andrew Carnegie

Shutterstock

Carnegie’s assertion links personal wealth creation to contributions that benefit others. It suggests that sustainable prosperity grows out of mutual gain rather than selfish accumulation. True financial success emerges when one’s actions, products, or services enhance the lives of customers, employees, and the broader community. It’s a model of wealth-building that values shared advancement.

“I’m only rich because I know when I’m wrong. I basically have survived by recognizing my mistakes.” – George Soros

Shutterstock

Soros’s statement points to humility and self-awareness as keys to financial longevity. It’s not infallibility that leads to prosperity, but the ability to admit errors and adjust course. Recognizing mistakes early prevents prolonged losses and fosters adaptive decision-making. This approach illustrates that long-term success often comes from learning, evolving, and embracing imperfection.

Conclusion

Shutterstock

As we reflect upon these profound insights, it becomes clear that money’s true meaning extends beyond mere numbers in a ledger. Wealth is not simply a collection of assets, but a pathway to influence, impact, and personal fulfillment. The perspectives shared by influential figures remind us that success without integrity, purpose, or gratitude can ring hollow. By embracing these guiding principles, we enrich not only our balance sheets but the quality of our lives and the communities we serve. Ultimately, the pursuit of wealth, when guided by values, can lead us to a more meaningful and enduring legacy.

Related Topics:

More From Financially+

-

25 Books That Will Teach You How to Get Rich

-

Things You Need To Stop Wasting Your Money On

-

Home Improvements That Could Land You In Big Legal Trouble…

-

38 Things To Consider Before Buying Your Next Car

-

Healthcare Workers Are Plagued By Financial Stress Amid Labor Shortages,…

-

DailyPay Secures $260 Million in Capital to Expand Globally and…