LIFE

Top 8 U.S. Cities For Affordable Retirement

Published

12 months agoon

Pinterest

Choosing a city for retirement on a budget involves considering factors such as cost of living, healthcare options, climate, and overall quality of life. Here are 20 U.S. cities that are often considered affordable for retirees:

1. Pittsburgh, Pennsylvania

Pinterest

Known for its affordability, Pittsburgh offers retirees a mix of cultural attractions, including museums and parks. The city’s affordable housing options, access to quality healthcare, and a diverse culinary scene make it an attractive destination for those seeking a balanced lifestyle.

2. Tulsa, Oklahoma

Pinterest

Tulsa boasts a low cost of living, making it an attractive option for retirees who can enjoy a range of cultural amenities, such as art galleries and music festivals, in a city known for its friendly community. The city’s revitalized downtown area and access to outdoor recreational activities add to its appeal for those looking for a vibrant yet affordable retirement destination.

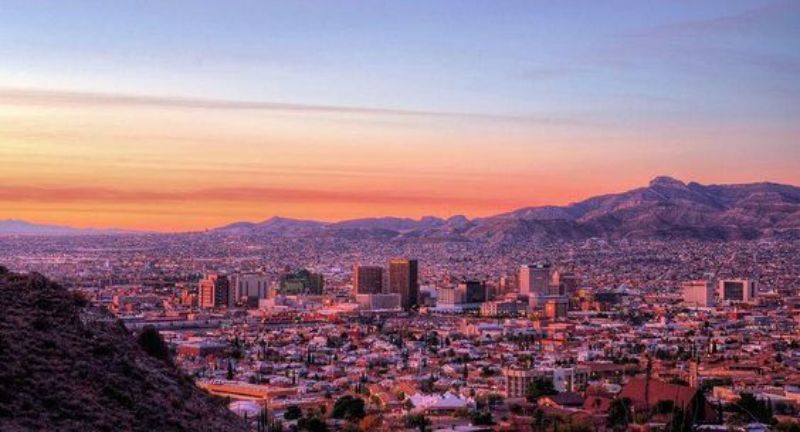

3. El Paso, Texas

Pinterest

With no state income tax and affordable housing, El Paso provides retirees a cost-effective lifestyle. The city’s warm climate, diverse culinary scene influenced by Mexican cuisine, and proximity to outdoor recreational opportunities, such as Franklin Mountains State Park, make it an appealing choice for retirees seeking affordability and a unique cultural experience.

4. Jacksonville, Florida

Pinterest

Retirees in Jacksonville benefit from no state income tax, a lower cost of living compared to other Florida cities, and a pleasant climate. The city’s proximity to beaches, diverse neighborhoods, and a range of cultural and recreational activities, including golf courses and parks, contribute to its appeal for retirees looking for an affordable yet vibrant retirement destination.

5. Omaha, Nebraska

Pinterest

Offering low unemployment rates and affordable housing, Omaha provides retirees with a stable and friendly community. In addition to its affordability, the city offers cultural attractions, parks, and recreational opportunities along the Missouri River, making it an appealing choice for those seeking a balanced and cost-effective retirement.

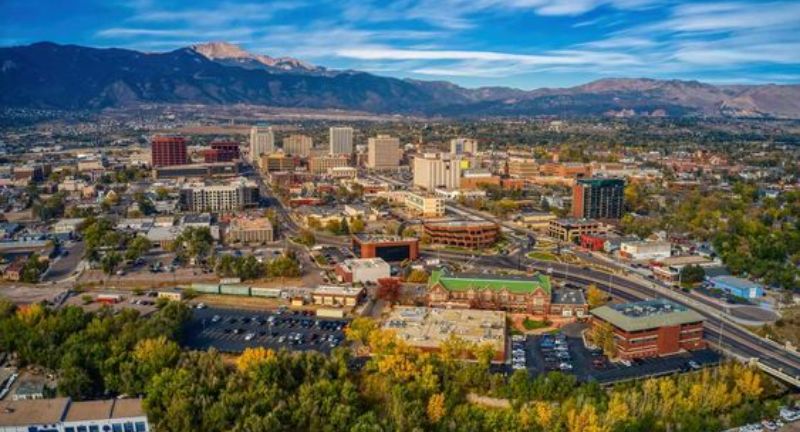

6. Colorado Springs, Colorado

Pinterest

With a lower cost of living than Denver, Colorado Springs attracts retirees with its scenic beauty, outdoor activities, and a moderate climate. The city’s proximity to Pikes Peak, Garden of the Gods, and a thriving arts scene contribute to its appeal, offering retirees a mix of natural beauty and cultural experiences in an affordable setting.

7. Huntsville, Alabama

Pinterest

Known for its low taxes and reasonable cost of living, Huntsville offers retirees a mix of cultural and recreational amenities, including museums, parks, and a strong sense of community. The city’s thriving technology sector, historical attractions, and southern hospitality contribute to its appeal for retirees looking for an affordable yet dynamic retirement destination.

8. Wichita, Kansas

Pinterest

Affordability is a key factor in Wichita, with retirees benefiting from affordable housing and healthcare. The city’s welcoming community, various cultural events, and a growing arts scene make it an attractive option for those seeking a cost-effective and culturally rich retirement.

Conclusion

Pinterest

Finding the perfect city for a budget-friendly and fulfilling retirement is a crucial decision, and the United States offers a diverse array of options for retirees seeking affordability without compromising on quality of life. From the cultural vibrancy of Pittsburgh to the warm charm of Tucson, these 20 cities present retirees with a spectrum of choices. Each city boasts its unique blend of affordability, healthcare access, recreational opportunities, and community spirit.

As retirees embark on this exciting chapter of their lives, exploring these cities provides a roadmap to a retirement that is not only financially prudent but also rich in experiences and possibilities. Ultimately, the key to a successful and satisfying retirement lies in the balance between financial considerations and the lifestyle amenities that make each of these cities a potential haven for retirees on a budget.

Related Topics:

More From Financially+

-

Ditch the 9-to-5: 30 Jobs with Flexible Hours

-

30 High-Paying Careers That Don’t Require a College Degree

-

38 Things To Consider Before Buying Your Next Car

-

30 Weird Jobs That Actually Pay More Than You Think

-

The Secret’s Out: South Carolina Is America’s New #1 Relocation…

-

8 Things That Are No Longer Worth Their Price

-

25 Frugal Living Tips We Can Learn From the Amish

-

9 Small Spending Habits That Add Up To Major Costs

-

8 Home Habits That Drain Your Wallet